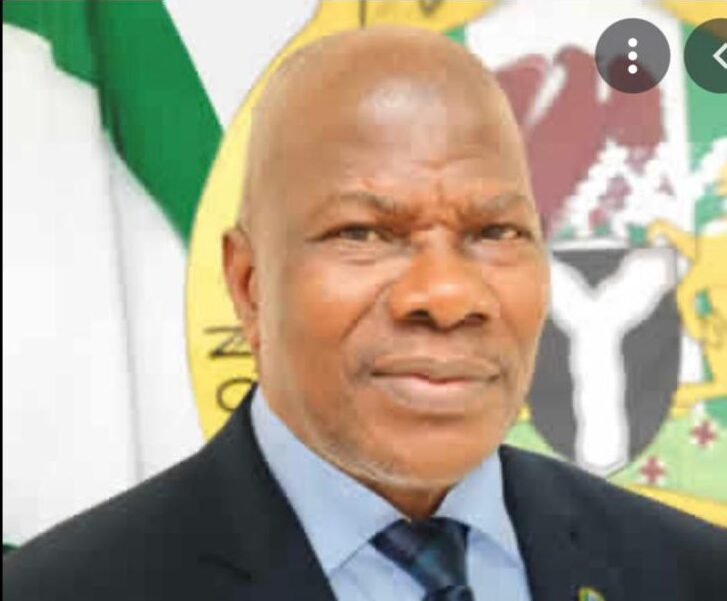

The Commissioner for Insurance and Chief Executive Officer (CEO) of National Insurance Commission (NAICOM), Olorundare Sunday Thomas, has condemned the non-payment of claims to policy holders by some insurance companies, saying that it is not good for the insurance industry.

He said that he is personally pained about what most insurance policy holders go through in the hands of insurance firms and vowed to put a stop to such practices.

Speaking during an interactive session with journalists in Lagos, Mr. Thomas said: “I can feel the anger and pain of all claimants and I assure them that we are doing everything in our power to address the issue of unpaid claims.”

On what the Commission is doing to curb the sharp practices by some under writers, Thomas also said: “We have stopped some companies from taking new business, but we do not have to announce it.

“We are concerned about all the stakeholders. The law requires us to be concerned about the policyholders and other stakeholders. I can feel the anger and pain of all claimants and I assure them that we are doing everything in our power to address the issue.”

On why NAICOM is not paying claimants from statutory deposits of erring firms, he said that the Commission is preventing a situation that would bring about a run on the insurance sector.

In the words of Mr. Thomas: “Imagine today, if somebody complains that he cannot get his money from the bank and Central Bank of Nigeria (CBN) pays from the bank’s deposit. What do you think will happen to even those who don’t have issues accessing their funds?

“There is a likelihood that they will think that something is wrong. People will run to both healthy and unhealthy companies to withdraw their money and the company will die, even before its time.

According to him: “But beyond this, the statutory deposit is mostly small and may not be able to pay off all liabilities. So, how do we approach this? The most likely thing is that we are going to have to do it on a first-come, first-serve basis. Will this be fair to all?

“The largest amount in their statutory deposit is probably around N300million for life and non-life companies while composite companies have N500million. So, how many claims can we pay with this? If, for instance, a corporate concern like Mobil applies to the deposit for an outstanding claim, what will be left to use for small policyholders that have smaller claims to collect? What are you going to tell them?

“The option is there to be used; and we believe that things will be different, with some of the steps that we are taking when what will be in the statutory deposit will be big enough. In any case, we do not believe that we will still have companies that will be owing to the extent of us trying to access their statutory deposit.”